Financial Markets Are Deceiving Us...

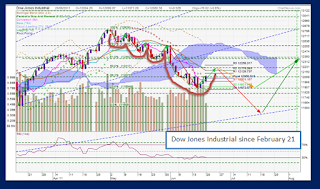

As you can see from the model portfolio activity , we actually made a successful exit in early April and have been sitting on the sidelines for most part. In the meantime, markets orchestrated one of the most deceiving moves off late, initiating a slowly mounting downside momentum in various forms without resorting to outright downward pressure. DJIA till end of summer 2011 These are the most dangerous of market conditions as we move from day to day, sliding down in small steps ( outline in red) , followed by seemingly contraindicating upsides in other regions of the world mixed with a few days of relief bounce every so often. It lulls many investor into believing that all's well, there is no cause for alarm. I BEG TO DIFFER! The current setup in this charts is just one example of many other financial markets, showing that the negative momentum is on the increase with each swing extending further down , - creating lower lows followed by reciprocal rebound action, surrept