Financial Markets Are Deceiving Us...

As you can see from the model portfolio activity, we actually made a successful exit in early April and have been sitting on the sidelines for most part. In the meantime, markets orchestrated one of the most deceiving moves off late, initiating a slowly mounting downside momentum in various forms without resorting to outright downward pressure.

These are the most dangerous of market conditions as we move from day to day, sliding down in small steps (outline in red), followed by seemingly contraindicating upsides in other regions of the world mixed with a few days of relief bounce every so often. It lulls many investor into believing that all's well, there is no cause for alarm. I BEG TO DIFFER!

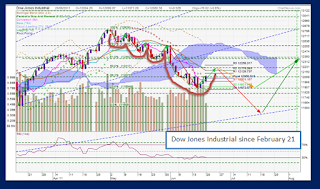

The current setup in this charts is just one example of many other financial markets, showing that the negative momentum is on the increase with each swing extending further down, - creating lower lows followed by reciprocal rebound action, surreptitiously relieving the tension that has been building up.

In the chart, I have outlined the next few weeks trading possibilities with 'red-down' and 'green-up' arrows: the lighter colours denote a more benign phase, which could arise if there is some really good news hitting the headlines. The darker colours, however, paint the logical final step of the previous price structures whereby the lows of February and Fibonacci fan support are the likely targets for a 'bottom' sometime in July, quite easily slicing another 6-8% off current valuations. Even the next rebound in August as indicated should be treated with the greatest respect as it must be considered, still, as a countertrend only in the arguably bigger and persisting downtrend of recent months.

Under the most fortunate of circumstances this rebound will bring us back to the highs of May (DJIA). Other markets may see similar action, but overall targets for downside and upside are inconsistent, not allowing for a sweeping statement either way.

The NASDAQ has yet to disappoint this year. The rally since last year August has yet to run out of steam, but it is near breaking point if the levels (in red) are breached significantly. As you can see I am instead expecting a strong performance in the NASDAQ - after the current correction has its course (see red arrow, green arrow).

Gold prices

... have yet to experience the kind of softness I was expecting. But I readily accept that the simple short term cycle analysis of the gold price in USD does not offer absolute directional advice. It will be a learning process to see how the world at large, outside the USD universe, experiences the gold price movement measured in local currencies in the next few months. (If this comment baffles you, then you may wish to read THIS blog again, published last April about gold as an asset class).

For the time being, I stick with my cautionary approach till later in July, though it may well be that, in SGD, gold prices won't suffer the kind of volatility that stocks and shares, - or currencies are due to suffer.

Model Portfolio Activity

We dared the market by entering equities - somewhat gingerly I might add - in late May trying to capture the last ride up as outlined in my last blog. The timing was perfect, - but the top came within days, and markets have since turned South again, leaving us no choice but to exit early last week!

Ever since then, most financial markets are succumbing to the negative sentiments so moribund in the investor community. The let-down in valuations appears ever so unassuming, with moves of little importance, easily disguising vital evidence which point to a potentially sharp drop in early July or so.

JULY 2011

Indeed, July might mark a major turning point for this year, since the first one, expected in March, was nullified by the Japan disaster.

Just be aware, that July is NOT a typical month to score points, or for traders to start pulling out all the stops, create huge volumes and massive opportunity when they have holidays on their mind. This next opportunity may arrive as stealthily as the downside we faced in the last 6 weeks: by the time we NOTICE the turnaround, the early benefits might have come and gone. Nonetheless, I expect some time symmetry in this action from July onwards, i.e. the ensuing rally may well last as long as the current downside,i.e. about 6-8 weeks, which would bring us the prospect of a rally peak in late August. Thereafter, we need to see whether reality in the markets matches cyclical forecasts enough to allow a more definitive comment.

The present outlook is supported by the NASDAQ, and the German Dax, which both remain in uptrends and are therefore the strongest proponent for a positive outcome of all the 'fundamental crap that is clocking up the system'. Derogatory comments? That is what all the worriers and bear market hopefuls will exclaim in consternation, - but what about those that firmly base their views on the chance that will resolve the present dilemma and permit the world to live and learn? At present at least, fundamental commentators ravel in the notion that their worst fears are coming into play. Such point of views are at least as 'irrational' as the position that every challenge will find a solution, even it turns out not quite as round and orange as is hoped.

Cutting to the Chase

At present, it is all about attitudes, especially when it comes to solving the Greek problem, and avoiding a Euro crisis. But the same can be said about the Arab spring, which in order to succeed will need to evolve into 'summer' soon, even IF their governments get hot under the collar in those 'temperatures'.

As for the European/Greek dilemma, I would identify two opposing (?) camps:

Asian Stock Markets

In Asia, bourses have been rather uncorrelated. Beginning of the year I pointed to Malaysia as the main market to give us good returns for our SGD. As of now, the relevant Malaysia fund is up 7%+ since February 21 (when we bought) without any notable volatility, even as other markets turn down as much as -10%. China, which I proposed to sideline since we sold off in early February, has lost all gains made in the rally from February to April (SHANGHAI INDEX & HANG SENG) and is now touching on lower levels not seen since September 2010.

For many that are seeing China as the front runner for the global economy such an outcome for Chinese stocks must seem as an anticlimax, and - a painful one if they listened to the majority of investment advisors here and abroad and invested heavily. The time for China stocks will come, dear investor - later this year, PROBABLY.

For many that are seeing China as the front runner for the global economy such an outcome for Chinese stocks must seem as an anticlimax, and - a painful one if they listened to the majority of investment advisors here and abroad and invested heavily. The time for China stocks will come, dear investor - later this year, PROBABLY.

As of now, the price structure in the charts suggests that the present downward trend is incomplete! The way I see it, another move down needs to come before the market is likely to receive support for - and see the start of - a sustained upward trend.

Many other stock exchanges have seen sizeable roller coasters, and as of now, ALL (except Malaysia) in negative territory for the year. The story for Asia, going forward. is more compelling than for many other markets. The key here is foreign investor cash flows.

|

| DJIA till end of summer 2011 |

The current setup in this charts is just one example of many other financial markets, showing that the negative momentum is on the increase with each swing extending further down, - creating lower lows followed by reciprocal rebound action, surreptitiously relieving the tension that has been building up.

In the chart, I have outlined the next few weeks trading possibilities with 'red-down' and 'green-up' arrows: the lighter colours denote a more benign phase, which could arise if there is some really good news hitting the headlines. The darker colours, however, paint the logical final step of the previous price structures whereby the lows of February and Fibonacci fan support are the likely targets for a 'bottom' sometime in July, quite easily slicing another 6-8% off current valuations. Even the next rebound in August as indicated should be treated with the greatest respect as it must be considered, still, as a countertrend only in the arguably bigger and persisting downtrend of recent months.

Under the most fortunate of circumstances this rebound will bring us back to the highs of May (DJIA). Other markets may see similar action, but overall targets for downside and upside are inconsistent, not allowing for a sweeping statement either way.

The NASDAQ has yet to disappoint this year. The rally since last year August has yet to run out of steam, but it is near breaking point if the levels (in red) are breached significantly. As you can see I am instead expecting a strong performance in the NASDAQ - after the current correction has its course (see red arrow, green arrow).

|

| Gold prices ...don't sparkle at present |

... have yet to experience the kind of softness I was expecting. But I readily accept that the simple short term cycle analysis of the gold price in USD does not offer absolute directional advice. It will be a learning process to see how the world at large, outside the USD universe, experiences the gold price movement measured in local currencies in the next few months. (If this comment baffles you, then you may wish to read THIS blog again, published last April about gold as an asset class).

For the time being, I stick with my cautionary approach till later in July, though it may well be that, in SGD, gold prices won't suffer the kind of volatility that stocks and shares, - or currencies are due to suffer.

Model Portfolio Activity

We dared the market by entering equities - somewhat gingerly I might add - in late May trying to capture the last ride up as outlined in my last blog. The timing was perfect, - but the top came within days, and markets have since turned South again, leaving us no choice but to exit early last week!

Ever since then, most financial markets are succumbing to the negative sentiments so moribund in the investor community. The let-down in valuations appears ever so unassuming, with moves of little importance, easily disguising vital evidence which point to a potentially sharp drop in early July or so.

JULY 2011

Indeed, July might mark a major turning point for this year, since the first one, expected in March, was nullified by the Japan disaster.

Just be aware, that July is NOT a typical month to score points, or for traders to start pulling out all the stops, create huge volumes and massive opportunity when they have holidays on their mind. This next opportunity may arrive as stealthily as the downside we faced in the last 6 weeks: by the time we NOTICE the turnaround, the early benefits might have come and gone. Nonetheless, I expect some time symmetry in this action from July onwards, i.e. the ensuing rally may well last as long as the current downside,i.e. about 6-8 weeks, which would bring us the prospect of a rally peak in late August. Thereafter, we need to see whether reality in the markets matches cyclical forecasts enough to allow a more definitive comment.

The present outlook is supported by the NASDAQ, and the German Dax, which both remain in uptrends and are therefore the strongest proponent for a positive outcome of all the 'fundamental crap that is clocking up the system'. Derogatory comments? That is what all the worriers and bear market hopefuls will exclaim in consternation, - but what about those that firmly base their views on the chance that will resolve the present dilemma and permit the world to live and learn? At present at least, fundamental commentators ravel in the notion that their worst fears are coming into play. Such point of views are at least as 'irrational' as the position that every challenge will find a solution, even it turns out not quite as round and orange as is hoped.

Cutting to the Chase

At present, it is all about attitudes, especially when it comes to solving the Greek problem, and avoiding a Euro crisis. But the same can be said about the Arab spring, which in order to succeed will need to evolve into 'summer' soon, even IF their governments get hot under the collar in those 'temperatures'.

As for the European/Greek dilemma, I would identify two opposing (?) camps:

- the camp of pragmatists, wanting to protect their interests in Greece and affected institutions.

- the camp of 'the self righteous', wanting to 'teach the Greeks a lesson', on how to conduct themselves in the EU, while warning off hopefuls wanting to join the EU, as well as other PIIGS states that could be next in the line of fire.

'isolating' the Greek debt problem from the rest of Europe (and the world), thus avoiding a 'contagion' effect on others when Greek debt goes into some form of default?But just how can that be achieved? It may interest you that according to some reports published by commentators at 'MarketWatch', about 40% of US banks have 'interests' in those European, especially French, banks that have considerable exposure to Greek governmental debts. And that may be only the tip of the iceberg in terms of cross-holdings that typically pervade the banking systems of Europe and the US. WHAT TYPE OF HAIR CUT WOULD SUIT TODAY, GENTLEMEN? Rescuing the situation is therefore tantamount to self preservation, no matter how hawkish the cry for punishment of an entire country. Then again, 'they', the people who thus mouth their frustration, are going unpunished because the Greek economy is only about 2% of the EU economy as a whole. Their voices are quickly silenced when bigger issues are at stake.

"There is of course a chance for serendipity and providence, which may add some lustre to a listless quagmire. "That's just me, hoping for some vitalising sense to prevail.

Asian Stock Markets

In Asia, bourses have been rather uncorrelated. Beginning of the year I pointed to Malaysia as the main market to give us good returns for our SGD. As of now, the relevant Malaysia fund is up 7%+ since February 21 (when we bought) without any notable volatility, even as other markets turn down as much as -10%. China, which I proposed to sideline since we sold off in early February, has lost all gains made in the rally from February to April (SHANGHAI INDEX & HANG SENG) and is now touching on lower levels not seen since September 2010.

For many that are seeing China as the front runner for the global economy such an outcome for Chinese stocks must seem as an anticlimax, and - a painful one if they listened to the majority of investment advisors here and abroad and invested heavily. The time for China stocks will come, dear investor - later this year, PROBABLY.

For many that are seeing China as the front runner for the global economy such an outcome for Chinese stocks must seem as an anticlimax, and - a painful one if they listened to the majority of investment advisors here and abroad and invested heavily. The time for China stocks will come, dear investor - later this year, PROBABLY. As of now, the price structure in the charts suggests that the present downward trend is incomplete! The way I see it, another move down needs to come before the market is likely to receive support for - and see the start of - a sustained upward trend.

Many other stock exchanges have seen sizeable roller coasters, and as of now, ALL (except Malaysia) in negative territory for the year. The story for Asia, going forward. is more compelling than for many other markets. The key here is foreign investor cash flows.

Comments