All That Noise...

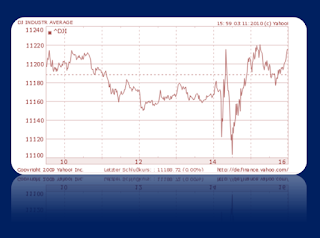

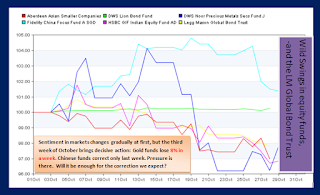

Well, it's inappropriate to placate the Korean skirmishes as "much ado about nothing". But the media's response is certainly over-dramatising it, and inappropriately so, when they claim that yesterday's bloodletting in Asian indices had anything to do with North Korea's desperate call for attention, military style. The first missiles hit the South Korean island at about 2:30h, with the barrage lasting about one hour. The South Korean index showed almost no reaction at the time and closed almost unchanged on the day of the attack. This morning we notice a knee-jerk in valuations at the opening, only to be completely retraced midday. Other indices like the STI below, were already on a downward slope, which simply continued without any reference to the trouble in Korea. What many fear now is that trouble keeps escalating, in Korea, with the European PIIGS, or any other misadventures courtesy of QE. What few acknowledge is that we have probably already t