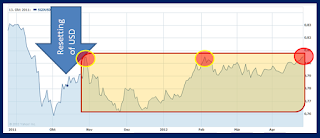

It is happening again: The Singapore Dollar is reaching 'danger zone' highs. For years now we Singapore Dollar investor have been struggling to harvest the gains around the world, as our currency has strengthened enormously. After a historic agreement on supporting the USD (- on a trade weighted level) versus a world currency in October last year, this stress situation has eased off. SGD-USD range still holding, BUT... From the 9-month chart you can see, that since the agreement, the most the SGD was allowed to buy was about 80.6 US cents, after which the MAS would take action to soften the currency's appeal. But every time we get back up to this level, its 'goose bumps time': will the currency break out of range? What will happen if it does, i.e. will the SGD again become the target of the 'risk averse' investor and surge much higher? Will the STI start looking even more listless? Do we have to change strategies from global to local again, just wh