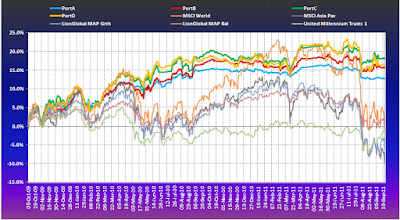

Portfolios rebalanced on September 2nd, 2011

Model Portfolios since inception in October 2009 to September 22nd, 2011. Model Portfolios will be updated monthly or when a significant change has happened.The latest data typically is always at least three days old, due to the forward pricing of its funds. For questions or comments please click here ! The fat lines are our portfolios, the narrow lines are benchmarks and indices. PortA , PortB , PortC and PortD are actively managed. PortE (not shown in the chart above, because inception was only beginning of 2011) is semiactively managed, i.e. switched every 3 months or on a larger longer-term change in trend. Click here for more info on this portfolio. La test update: September 22, 2011 Our Portfolios are now some 20-25% ABOVE global and Asian market indices and benchmark funds, when viewed since inception, almost exactly 2 years ago. Switches since inception: We have made a few more switches since May 2011, the previous update (last transactions