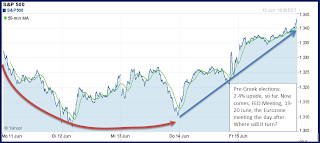

A bloody Monday for financial markets

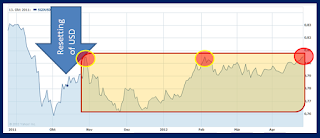

Rumours are flying over Greece's impending bankruptcy (again) and Germany's politicians shouting their mouths off over what Athens will or will not get (concessions, extensions, more money, more time...). Spain is banning to go short on equities. China's economy is still slowing down, oil prices fall and the USD goes into overdrive. All that jazz while Yahoo!Finance is frozen stiff, stuck on Friday's figures, not revealing to us ordinary folks the damage being inflicted right now. With the bad stuff piled up suitably, the 'news' of old news, in the meantime, has created a bloodbath in the market streets from Sydney to Frankfurt. It is 10:00 p.m. in Singapore now, and the losses amount to -4%. Efficient markets my foot! The world was a piece of cake till Thursday last week. Now we're going through probably the worst day year to date as far as I recall. But what will come of it? Mercury retrograde, is a time when you should not trust any so-called