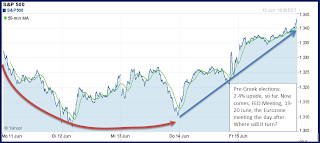

'Markets Jumping The Gun'

S&P500, 5-day view, "jumping the gun" as early as Tuesday... THE FIVE-DAY VIEW: In a race, the rally since Thursday last week would be deemed a 'false start' and participants would be disqualified, coming out of the blocks 3 days early. - I say, 'false start' because, the outcome of Greece's second election attempt was NO foregone conclusion. Yet markets rallied! In the financial world, however, such a 'false start' will be attributed to luck, as long as the result confirms investors' anticipations, - or bad timing if the markets were to go down after that! DAX - moving up hesitantly Comparing the two charts on the left, you will note that the S&P500 (chart above) leads the DAX (second chart) by at least 2 days: S&P 500 starts its rally on Tuesday, the DAX waits till late Thursday. The medium-term technical picture suggested that the DAX had been leading the US by as much as 2 weeks. A deviation from that pattern is ...