"Soft Landing" ahead!

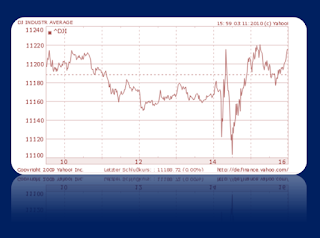

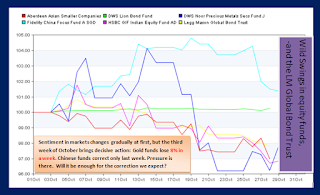

Merry Christmas 2010 As expected by our cyclical research, markets are treading a bit softer over the coming few trading days before a final push into the New Year . Whether the actual downside pressure will amount to much remains to be seen. I don't see swings of more than -2/-3%. This softness in the markets will manifest itself different in the various countries and sectors, - which is really what we are seeing in our portfolios at the moment: Gold rallied into $1425 (Dec 6), and is on a slide since. I expect prices to remain above $1360 per ounce. China stocks are having a tough time rallying, and even Indian and Singapore indices are somewhat lackluster. Currencies continue their rollercoaster moves. In other words, nothing out of the ordinary for the Christmas season: lower volumes, the annual window dressing exercise by institutional investors, clearing the deck of non-performers and of course early profit taking. Overall our portfolios are mildly in plus after