WHAT VALUE IS GOLD?

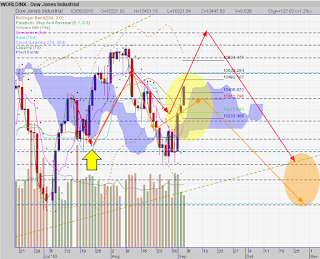

With Gold prices now closing above USD 1300 per ounce, it deserves a closer look, despite the fact that for us mutual fund investors, capturing the rise in value is a formidable challenge. And I am keeping the info especially "lite". Little attempt is being made at substantiating the current prospects for gold, which others can do so much better. I thought it more important to putting it into perspective for the purpose of portfolio management. The following is an excerpt from the latest SingCapital Market Update, normally reserved only for SingCapital Advisors. Is Gold becoming the driving factor to the much publicised asset bubble, supposedly forming when inflation runs rampant? Gold prices move to ever new highs! It is only HIGH in relation to the USD. Indeed, gold prices now appear to form a (short term) speculative bubble in relation to the USD. In case you are not sure, - I call it a bubble when market activity in a particular asset increases disproporti