Portfolios rebalanced on September 2nd, 2011

|

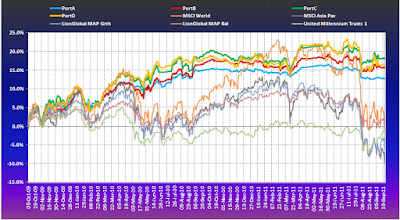

| Model Portfolios since inception in October 2009 to September 22nd, 2011. |

Model Portfolios will be updated monthly or when a significant change has happened.The latest data typically is always at least three days old, due to the forward pricing of its funds. For questions or comments please click here!

The fat lines are our portfolios, the narrow lines are benchmarks and indices. PortA, PortB, PortC and PortD are actively managed.

PortE (not shown in the chart above, because inception was only beginning of 2011) is semiactively managed, i.e. switched every 3 months or on a larger longer-term change in trend. Click here for more info on this portfolio.

Latest update: September 22, 2011

Our Portfolios are now some 20-25% ABOVE global and Asian market indices and benchmark funds, when viewed since inception, almost exactly 2 years ago.

Switches since inception:We have made a few more switches since May 2011, the previous update (last transactions on top):

17. September 5th, 2011, exiting all equity including gold futures

16. August 24th, 2011, partially rebuilding equity positions (about 30-45% according to risk profile) THIS WAS A SWITCH ACTION ONLY FOR HIGHER RISK PORTFOLIOS, i.e.Port B-D. Port A remained cautious throughout, as the risk profile requires.

16. August 24th, 2011, partially rebuilding equity positions (about 30-45% according to risk profile) THIS WAS A SWITCH ACTION ONLY FOR HIGHER RISK PORTFOLIOS, i.e.Port B-D. Port A remained cautious throughout, as the risk profile requires. 15. August 5th, 2011, exiting all equity except gold futures fund

15. August 5th, 2011, exiting all equity except gold futures fundolder transactions:

Most times, we switch almost all portfolios at the same time, regardless of investor risk. As a result, the top two risk portfolios perform rather similar in the short term and their differences will become apparent only after a longer period.

We use iFAST or iGP platform to manage our portfolios and all normal transactions procedures apply.

Comments