|

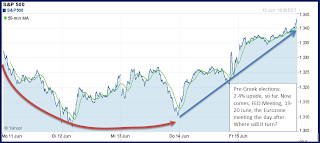

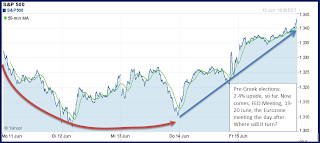

| S&P500, 5-day view, "jumping the gun" as early as Tuesday... |

THE FIVE-DAY VIEW:

In a race, the rally since Thursday last week would be deemed a 'false start' and participants would be disqualified, coming out of the blocks 3 days early. - I say, 'false start' because, the outcome of Greece's second election attempt was NO foregone conclusion. Yet markets rallied! In the financial world, however, such a 'false start' will be attributed to luck, as long as the result confirms investors' anticipations, - or bad timing if the markets were to go down after that!

|

| DAX - moving up hesitantly |

Comparing the two charts on the left, you will note that the S&P500 (chart above) leads the DAX (second chart) by at least 2 days: S&P 500 starts its rally on Tuesday, the DAX waits till late Thursday. The medium-term technical picture suggested that

the DAX had been leading the US by as much as 2 weeks. A deviation from that pattern is therefore significant. There is of course a practical side to this: the 'US', its big instutions, 'Ze Big Boys' dictate what happens in the markets at present. Buying or selling orders originate in the US and then go round the globe; not always,- but certainly when market are in 100% correlation.

|

| Hang Seng - turning early in May |

Turning Markets

By consensus, the 'Greek election' was

the key factor supposedly moving everything in the markets. On the surface it may look like that, but global stock markets are really out of sync. The Hang Seng, for instance, recorded its lowest point on June 4th, and has since been moving up gradually. The index displays clear signs of a breakout pattern, above Bollinger Bands, above Fibonacci pattern and above previous resistance levels in May.

|

| India, mired in a downward trend |

Against that the Indian SENSEX looks mired in probably the most bearish pattern in Asian markets. The latest rebound takes the form of (half-a-) dome, especially ominous when you add todays' downday. I am observing a pattern suggesting India, and the sentiment in its stock markets, starts every downward move in recent times, followed by Europe, then the US and finally East Asia.

|

| India - 5days, , before and after the Greek Election 2 |

With India going down again TODAY, when most other markets are up, alarm bells should be ringing. The negative pattern constrasts with a rising Euro and a bullish pattern in gold prices. In my previous posting I also showed the bullish divergence now forming between stock markets and various indicators. In short, this is hardly the stuff of conclusive evidence for any direction.

May I remind you that this election result in Greece is bound to bring grief over who pays for all of it and when, if at all! The expected 'relief' over Greece's choice to stick the Euro and the austerity package did not lead to lower yields for Spanish and Italian bonds.

Europe is still up against enormous obstacles.

It ain't over till Lady Merkel sings - the tune her European counterparts want to hear, and one that investors will endorse.

These are mischievious times for investors and advisors, and - at the risk of repeating myself - terribly frustrating for both bulls and bears. One commentator in 'Traders Planet' today warns of NOT GOING WITH THE OBVIOUS INVESTMENT CHOICES, now. Had he not clarified it the 'obvious investment choice = buy safety', I would have called it ambiguous humbug. Frankly, there are

no obvious investment choices out there today. I maintain my earlier call for caution.

Comments