Partial Profit Taking Exercise is called for!

Well considering that our portfolios have a large exposure to Asian equity, a call for partial profit taking is well timed! Many Asian indices have rallied for the last 2 weeks or so. For our portfolios, we have already taking steps on Monday and yesterday,selectively reducing our equity holdings between a third and half, according to the applicable risk profile.

| |

| Indian BSX - All bets on a rally are off if below 17500 |

|

| Brazil's BOVESPA also subject to strong FDI drain. |

It is rather daunting to see European and US stocks continuing their rally while Asian stocks linger at best or continue correcting since the highs last November. I have stated in the last update, that there is really no valid fundamental backdrop for this to happen. As yet no one has come forward to argue against my observation that it is all down to Foreign Direct Investment (FDI) outflows, in particular in India and Latin America.

|

| STI - following a sideways pattern from Dec 2010 |

|

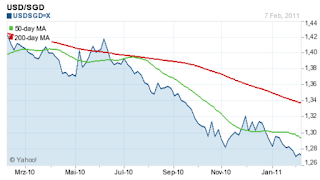

| USD buying less and less SGD |

The downdraft is exacerbated by the strength of the SGD, now at near 1.27 level against the USD. The risk-reward ratio becomes less and less advantageous for investment outside of Singapore, except for investment in AUD, which remains strong. Will this trend (a strong SGD) continue? If you know how the Singapore Dollar is managed then a firm 'YES' should not surprise. What stands in its way? Only a serious political mistake or a sudden, sharp downturn in Singapore's fortunes? Foreseeable? You are the judge.

Apart from disadvantaging foreign equity funds, the strong SGD has been biting into global bond values, which I continued to promote for lower risk portfolios, pending a sizeable consolidation in equity markets this month. But as yet, bonds have seen no reversal of fortunes. By the time we get into end of February, we will finally avail ourselves of these positions.

Lastly, gold prices have seen triple peaks late last year and are correcting since. This is ongoing and could last throughout February. $1383 is the price level at which the fortunes of gold could start to reverse. But before that we may well see prices below $1300.

Since it is the start of a New Lunar Year of a 'hopping' rabbit, the observant Asian investor may see the recent markets moves as hints of what's in store this year. Is it then time to reduce your return expectations for Asian and the emerging market equity, while liquidity flows back to the developed worlds? The phenomenon is called ASSET ROTATION, and will be a notable feature in this year's trading habits, consummate with the rabbit's notorious habit to change directions when the carrot in the other garden looks more appetising, - or when pursued by an enemy, real or imaginary.

GONG XI FA CHAI - have a successful year.

Comments