"China' - Not Just Pretty Pictures". A slide show from July 30th, 2010

|

Prepared for presentation on July 30th, 2010. For a larger view please click on the slides.

|

PAUL, the Octopus, has retired from soccer mania but - 9 brains to entertain children? Some spare capacity is to be expected. Recent communication with him revealed that he is tipping for China to pull the world out of trouble. "Mussels are in the mail,buddy!"

|

Positive returns for most global markets, except two, China - and Greece. We are not concerning us with the latter but want to explore why the Chinese Mainland bourses have not stopped correcting since August last year.

|

A market that is closed to foreign direct investment reflects more closely what is happening "on the ground". The measures to control a potential overheating have been outlined and chewed over in the media often enough. Once the foreign component is added (overlay of Hang Seng in Hong Kong, below the SSE graph) the picture changes and the sentiments of foreign market participants spill over into the overall market activity.This is why during that period the Hang Seng has seen only a fraction of the volatility so prevalent in the SSE180.

|

Foreigners rarely have access to 'A' shares, which are traded on the Mainland. 'H' shares are the playground for foreign institutions, fund managers etc. Some Chinese companies went on to become listed on the SGX (that's why they are called 'S' shares).

|

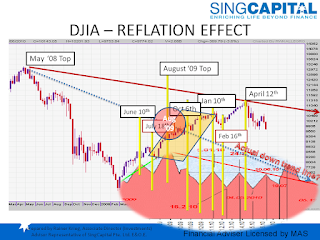

Overlaying the DJIA with the Supercycle for the DJIA shows the importance of the cycle to future DJIA movements. But it also shows how human intervention after April 2009 (see orange shape) distorts the outcome: After the ultimate low point in March 2009, the decision was made to pour trillions of USD and other currencies into endangered banks to 'safe the financial system'. Much of this money found its way back into equity markets. and thus created a period when 'normal' investment conditions became defunct.

As a result, we could argue that the DJIA of today is out of shape by the difference between the long red line, denoting the downward trend since May 2008, adjusted for the reflation impact, - and the long blue line, which ignores the artificial exuberance. The latter portends the somewhat grimmer outlook that the DJIA may well revisit the March 2009 lows before a new bull market can start. It would be foolish to totally ignore the possibility.

|

Here we see the SSE overlaid by the Supercycle, and for what it's worth, the correlation is striking, and much more in line with expectations. It would suggest that out of all major global indices, stocks on the Chinese Mainland index are the most adequately priced.

|

Having transgressed the time lines as implied by the Fibonacci fan (blue diagonal lines), the market (SSE) is free to choose a new path, at a level where it has corrected sufficiently and finds solid support, if only from the Fibonacci level. Since then markets have indeed already rebounded over 6%!

|

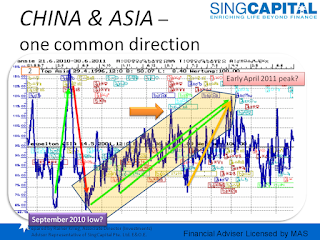

In a rare glimpse into my cycle analysis I am pointing toward a period after August, when many markets are due for a correction of some magnitude. It shows that indeed from that point, the China story is finding strong support and indices on the Mainland could see a solid, albeit volatile rally, all the way to May 2011.

|

This outlook is supported by a study into future trends in Asian equity funds. Depending on the strategy there are several points at which to take profit - and top up, too.

|

This chart was provided in Dr Shane Oliver's recent report. It strongly supports the notion of a decoupling process, which has started as early as 1990. The process became overshadowed by the tech bubble bursting, forcing markets run almost 100% in sync. But shortly thereafter decoupling is picking up pace again. One common yet misconstrued argument in this respect says that 'decoupling' must be accompanied by succinct non-correlation between the respective markets. I don't think that this is a prerequisite to the outcome.

|

In a nutshell, investing into China via H, S and A shares should really start now, with a strategy of using market dips for further purchases over the coming few months. A solid rally is forecast.

|

Some points for considerations and contemplation that are clearly ahead of us still, but will impact us no doubt.

Comments