Introduction to the SingCapital Investment Approach

The last few years have wrought havoc with many investor portfolios, while undermining their long held belief of "good fortune for all and sundry" when investing in financial markets. Professional and amateur investor alike are calling into question the age-old, empirically supported theory that tells of "forever rising markets in the long term". May be it should read, "if we can wait long enough"?

By the same token, investment advisors are faced with difficult choices: they could

For over a year now, we, at SingCapital Pte. Ltd., have been working on a simple enough, yet effective guide that helps you invest your hard earned money successfully, - even if you are a novice to the investment world.

Bearing in mind that we only deal with Collective Investment Schemes (C.I.S) like mutual funds, investment trusts, bonds and Exchange Traded Funds (ETF), we focus our efforts - NOT on short term market gyrations - BUT a three-to-six-month investment horizon to guide us toward longer term investment targets.

The tools we use to analyse investment opportunities in financial markets are

Investor background

We realise that every investor has unique objectives over various time lines. These can best be achieved with the help of a properly qualified financial advisor / planner.

Every road map toward a successful financial plan must contain a clear framework of dos and don'ts, - disciplines that will ensure your plan is on track to achieve what it set out to do. Embracing such a principled approach is vital for success and both, investor and advisor, need to work together on how best to implement the agreed framework.

What's in this blog?

This blog cannot replace the person to person relationship between the client and his advisor. But we think we can offer some help with - what we consider - the most important and potent factor: - concise risk management signals. The signals are generally designed to increase your chances to

In the right hands, this tool enables you to

To showcase our investment approach, technical assessments of the investment conditions, the signals and our time sensitive recommendations and how they have resulted in a positive outcome, we have created model portfolios for three different risk profiles:

Having said that the quality of investment tools may vary. In addition, the impact of investing in another currency than Singapore Dollars will further create discrepancies between what the SingCapital's model portfolio achieves and one you may create wherever you may reside, even though you have successfully managed to mirror the allocation within your portfolio to that of our model portfolio.

No portfolios will ever work for you - that is - produce positive gains in the long run, UNLESS a few essential principles are applied.

PLEASE NOTE:

THESE PORTFOLIOS ARE MODELED IN ACCORDANCE WITH THE 'PROACTIVEMANAGEMENT' APPROACH. THE MODELS UNDERGO SOME CHANGES ALMOST ON A MONTHLY BASIS. THE CHANGES CAN LEAD TO THE PORTFOLIO TO HOLD 100% IN CASH UNDER ADVERSE INVESTMENT CONDITIONS.

ACTUAL CLIENT PORTFOLIO RETURNS MAY DIFFER AS A RESULT OF EXTENDED SWITCHING PERIODS, ONGOING FEES, WITHDRAWALS AND/OR TOP UPS.

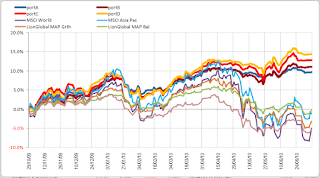

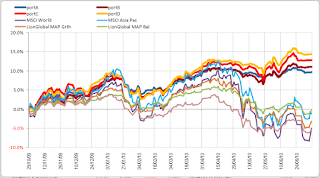

The bold lines paint the progress of our model portfolios: the higher they are in July 2010 (table right), the higher the risk profile.

The bold lines paint the progress of our model portfolios: the higher they are in July 2010 (table right), the higher the risk profile.

Click on the picture to obtain a larger, clearer view.

We managed to cruise through the first pitfall in January/February 2010, took profit (and switched to safety) in April, were lucky to re-enter equity funds in the third week of May at a low point - but have since taken profit again, in late June, and are currently 90% in cash. Indeed, we are ready to pounce when markets how early signs of starting the next leg in the summer rally...

As of early July 2010, the difference between portfolio progress and the MSCI World Index is about +20%(!), and about +15% to other benchmarks and our peers in the managed fund segment.

A - not so - secret Mantra for Investors

If you have had any dealings with property , you may have heard this a zillion times: the winning mantra is

When investing in financial markets the mantra sounds similar:

We will hardly ever be able to influence the big fund houses and their esteemed managers to allocate according to our wishes. They have their own objectives and parameters to follow, - and so they should, because we hope they will produce their best when we recommend investing in their funds.

It is therefore the financial advisor's prerogative to bring about the right allocation of assets according to the risk profile of the client, the individual investment objective, - and the prevailing investment conditions. While property is priced for its fixed location, the best place for investments is where the asset allocation adjusts to varying investment conditions.

Dare I say that our investment approach is bearing fruit?

There is more to come ...

By the same token, investment advisors are faced with difficult choices: they could

- Acknowledge that hitherto popular, well respected and frequently applied investment principles failed to serve investors as well as anticipated,

- Learn quickly what changes are necessary to make money in the markets of today - and live to serve another day

- Or - GET OUT OF BUSINESS

For over a year now, we, at SingCapital Pte. Ltd., have been working on a simple enough, yet effective guide that helps you invest your hard earned money successfully, - even if you are a novice to the investment world.

Bearing in mind that we only deal with Collective Investment Schemes (C.I.S) like mutual funds, investment trusts, bonds and Exchange Traded Funds (ETF), we focus our efforts - NOT on short term market gyrations - BUT a three-to-six-month investment horizon to guide us toward longer term investment targets.

The tools we use to analyse investment opportunities in financial markets are

- sophisticated, professional, well researched - and well applied;

- specifically tuned to provide the right signals for our chosen investment horizon.

Investor background

We realise that every investor has unique objectives over various time lines. These can best be achieved with the help of a properly qualified financial advisor / planner.

Every road map toward a successful financial plan must contain a clear framework of dos and don'ts, - disciplines that will ensure your plan is on track to achieve what it set out to do. Embracing such a principled approach is vital for success and both, investor and advisor, need to work together on how best to implement the agreed framework.

What's in this blog?

This blog cannot replace the person to person relationship between the client and his advisor. But we think we can offer some help with - what we consider - the most important and potent factor: - concise risk management signals. The signals are generally designed to increase your chances to

- take profit when appropriate,

- prevent unnecessary losses,- but also cut losses when a preset level is breached,

- signal investment opportunities straight ahead.

In the right hands, this tool enables you to

- build,

- monitor and

- re-balance your portfolio

To showcase our investment approach, technical assessments of the investment conditions, the signals and our time sensitive recommendations and how they have resulted in a positive outcome, we have created model portfolios for three different risk profiles:

- low-medium risk, which we term 'BALANCED'

- medium - high risk, which we term 'GROWTH'

- high risk, which we term 'TREND DRIVEN'

Having said that the quality of investment tools may vary. In addition, the impact of investing in another currency than Singapore Dollars will further create discrepancies between what the SingCapital's model portfolio achieves and one you may create wherever you may reside, even though you have successfully managed to mirror the allocation within your portfolio to that of our model portfolio.

No portfolios will ever work for you - that is - produce positive gains in the long run, UNLESS a few essential principles are applied.

- Manage your risk exposure according to your risk profile.

- Harness portfolio gains every so often.

- Seek advice on the strength of the trend you are invested in, - and take precautionary steps as it peaks, turns sideways, or - down.

- Accept a certain volatility in the portfolio, as it will help produce the returns you seek. BUT PUT A LIMIT TO IT. - And be brave enough to cut lose when the limit is breached!

- DO NOT INVEST INTO FALLING MARKETS, unless the chosen investment tool is designed to produce positive returns under such adverse conditions.

- Have a personal coach, who can support you and proactively engage with you when it is appropriate.

- Don't be a lazy investor: don't invest and forget about it.

PLEASE NOTE:

THESE PORTFOLIOS ARE MODELED IN ACCORDANCE WITH THE 'PROACTIVEMANAGEMENT' APPROACH. THE MODELS UNDERGO SOME CHANGES ALMOST ON A MONTHLY BASIS. THE CHANGES CAN LEAD TO THE PORTFOLIO TO HOLD 100% IN CASH UNDER ADVERSE INVESTMENT CONDITIONS.

ACTUAL CLIENT PORTFOLIO RETURNS MAY DIFFER AS A RESULT OF EXTENDED SWITCHING PERIODS, ONGOING FEES, WITHDRAWALS AND/OR TOP UPS.

The bold lines paint the progress of our model portfolios: the higher they are in July 2010 (table right), the higher the risk profile.

The bold lines paint the progress of our model portfolios: the higher they are in July 2010 (table right), the higher the risk profile.Click on the picture to obtain a larger, clearer view.

- Port A caters to a balanced investor,

- Port B to a growth investor,

- Port C to a trend driven investor,

- Port D, a CPF investment with a high risk appetite.

We managed to cruise through the first pitfall in January/February 2010, took profit (and switched to safety) in April, were lucky to re-enter equity funds in the third week of May at a low point - but have since taken profit again, in late June, and are currently 90% in cash. Indeed, we are ready to pounce when markets how early signs of starting the next leg in the summer rally...

As of early July 2010, the difference between portfolio progress and the MSCI World Index is about +20%(!), and about +15% to other benchmarks and our peers in the managed fund segment.

A - not so - secret Mantra for Investors

If you have had any dealings with property , you may have heard this a zillion times: the winning mantra is

LOCATION - LOCATION - LOCATION.

I am sure all our colleagues in our sister company, propnex, are happy to concur.

When investing in financial markets the mantra sounds similar:

ASSET ALLOCATION, ASSET ALLOCATION, ASSET ALLOCATION

We will hardly ever be able to influence the big fund houses and their esteemed managers to allocate according to our wishes. They have their own objectives and parameters to follow, - and so they should, because we hope they will produce their best when we recommend investing in their funds.

It is therefore the financial advisor's prerogative to bring about the right allocation of assets according to the risk profile of the client, the individual investment objective, - and the prevailing investment conditions. While property is priced for its fixed location, the best place for investments is where the asset allocation adjusts to varying investment conditions.

Dare I say that our investment approach is bearing fruit?

There is more to come ...

Comments