SingDollar Blowing Its Top Again?

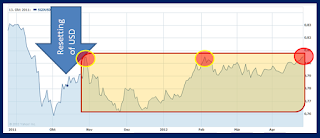

It is happening again: The Singapore Dollar is reaching 'danger zone' highs. For years now we Singapore Dollar investor have been struggling to harvest the gains around the world, as our currency has strengthened enormously. After a historic agreement on supporting the USD (- on a trade weighted level) versus a world currency in October last year, this stress situation has eased off.

From the 9-month chart you can see, that since the agreement, the most the SGD was allowed to buy was about 80.6 US cents, after which the MAS would take action to soften the currency's appeal. But every time we get back up to this level, its 'goose bumps time': will the currency break out of range? What will happen if it does, i.e. will the SGD again become the target of the 'risk averse' investor and surge much higher? Will the STI start looking even more listless? Do we have to change strategies from global to local again, just when it is starting to look interesting? Or is the uncharacteristically narrow trading range and lack of volatility in currencies pink-colouring our perception?

Short Term View

Last months' spikes in the S&P500 may be considered 'low velocity' (=lower risk) and many observers make a case of a bullish market right now. Over the last fortnight this did not help Singapore dollar investors, because our buying power went up more than 1%, - which is the growth we record for the index. And we are holding substantial weightings in SGD cash ever since March 16.

Our strategy still favours a bond&Singapore dollar oriented allocation of at least 50%, with the remaining allocation being spread between global equity and bonds. The surge in the SingDollar is "messing things up" a little.

Right Fund Choice

During a correction phase as the one since mid-March, I expected the USD to strengthen vis-a-vis Asian currencies, i.e. the SGD. I therefore opted for a US bond fund denominated in USD, rather than the SGD hedged version. We invested around March 20/21, so the purchase prices were somewhat lower than shown here in the 1-month view. Still, the surprise rise of the SGD versus USD has meant that our chosen fund underperformed by some 1%.

So, is the SGD at the upper ceiling and gets rebuffed? Markets seem poised to move higher now, ... with a stronger USD? Normally NOT. Should we then get out of US bonds for the sake of a short term (=another fortnightly) blip?

Stocks in the US were up in recent days, - BUT SO WERE US TREASURIES! Tensions are rising in an irregularly correlated market that somehow needs to unwind, with no obvious winner just yet. I am really looking for the unwinding to start before instigating the necessary changes. A few more days of patience are called for.

|

| SGD-USD range still holding, BUT... |

Short Term View

|

| SGD versus S&P500 over 14-day period |

Our strategy still favours a bond&Singapore dollar oriented allocation of at least 50%, with the remaining allocation being spread between global equity and bonds. The surge in the SingDollar is "messing things up" a little.

Right Fund Choice

|

| VIEWED IN SGD: US bonds 'straight' - and hedged back to SGD |

So, is the SGD at the upper ceiling and gets rebuffed? Markets seem poised to move higher now, ... with a stronger USD? Normally NOT. Should we then get out of US bonds for the sake of a short term (=another fortnightly) blip?

Stocks in the US were up in recent days, - BUT SO WERE US TREASURIES! Tensions are rising in an irregularly correlated market that somehow needs to unwind, with no obvious winner just yet. I am really looking for the unwinding to start before instigating the necessary changes. A few more days of patience are called for.

Comments