Markets bounce back! So does Gold, finally!

September 29th was indeed a major turning point in global financial markets, +/- 1 day. That was my target date, so predicted in my previous post. From those low levels, markets moved sharply, some even returning to previous highs.

Curiously, I noted that USD investors quickly switched to Asian equity and - gold funds in the last week of September, thus avoiding the trap of remaining stuck in a weakening dollar environment. It is also the main reason for the outperformance in some Asian and European equity sectors.

Since September 29th, we are about midway through! To give you a detailed picture I would need to refer to the market cycles again. I could also show you more than a handful of charts, so as to point out which market will do best from here. I fear that if you managed to read up to here, you are already stressed to the limit...

Since September 29th, we are about midway through! To give you a detailed picture I would need to refer to the market cycles again. I could also show you more than a handful of charts, so as to point out which market will do best from here. I fear that if you managed to read up to here, you are already stressed to the limit...

USD goes soft

Having started on September 29, and recording its first peak on October 8th, this well supported equity rally was accompanied by a weakening US dollar (-3% against global currency basket) as more and more investors convinced themselves that the FED would not raise interest rates until next year. It is important to see the US stock performance in this light, too, especially if you normally place your investment in EUR or some Asian currencies like the Singapore Dollar (*SGD), all of which saw their local currencies strengthen.Curiously, I noted that USD investors quickly switched to Asian equity and - gold funds in the last week of September, thus avoiding the trap of remaining stuck in a weakening dollar environment. It is also the main reason for the outperformance in some Asian and European equity sectors.

Rally winners

For those who managed to switch into this rally in time, you should now be able to see about 3-4% growth in Chinese, European and Japanese equity funds (in SGD), and - not surprisingly - as much as 7% in some Gold equity funds. Again, the rise in gold comes about solely as a result of the weakening dollar: As soon as the US dollar started to sink, gold prices rallied. At dollarDEX, Singapore, gold funds are listed as top performing funds in their current monthly returns listing.| UOBAM United Gold & General | +25.42 |

| DWS Noor Precious Metal | +22.53 |

| BlackRock GF World Gold Fund | +19.83 |

| UOBAM United Global Resources | +17.49 |

| Franklin T Franklin Gold and Precious Metals | +14.20 |

Even the weekly performance listing of fundsupermart, Singapore, shows gold and related equity funds at the top.

Top performing regions in Europe

Top performances in US sectors

| Best Performing (1 WEEK) | |

| Fund Name | % |

| Deutsche Noor Prec Metals CL A USD | 7.36 |

| Blackrock World Gold Fund A2 SGD-H | 6.62 |

| Deutsche Noor Prec Metals CL J SGD | 6.51 |

| United Gold and General Fund | 6.15 |

| Schroder AS Gold and Prec Metals A Acc SGD-H | 5.43 |

Equity

Top performing countries in Asia:

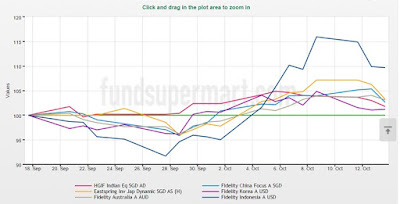

Up until the 8th October, the top performing country in Asia was Indonesia, starting the rally on Monday 28th September. Second is Japan, then Korea, India and China following closely.

Top performing regions in Europe

In Europe, the best equity returns came from UK, France and Italy. Helped by gold and oil prices, even a multi-asset fund with a European focus held up exceedingly well, and incur a lot less price volatility.

Top performances in US sectors

More than other markets, the key to obtaining top performance in US equity was a perfect entry on the 29th of September! US markets did perform, though markedly lower than Asia and Europe. Still, the funds we monitor, delivered what was expected of them. The best performance was about 8% to October 8th.

All pretty much as anticipated in my advices to my fee-paying clients.

Please note, the funds I mention here are purely for comparison only. Don't mistake these as recommendation for anything, least of all your investment.

Commodities

For quite a while, I ignored all allocations to commodities (other than precious metals), and Latin American equity funds. The upside potential versus the risk just did not warrant it in my books. And it still does not.

Some say, oil prices will go up till end of the year. Well, two factors play their part:

1. the USD continues to weaken.

2. The tensions in the Middle East increase.

Both these triggers are in effect at present. I don't wish it, but suspect that rising tensions in the Middle East will force the prices more than anything else.

Timeline to the end of the Rally

Since September 29th, we are about midway through! To give you a detailed picture I would need to refer to the market cycles again. I could also show you more than a handful of charts, so as to point out which market will do best from here. I fear that if you managed to read up to here, you are already stressed to the limit...

Since September 29th, we are about midway through! To give you a detailed picture I would need to refer to the market cycles again. I could also show you more than a handful of charts, so as to point out which market will do best from here. I fear that if you managed to read up to here, you are already stressed to the limit...

To go easy on you, I suggest you look to the first week for a profitable exit point for equities anywhere, although you could consider leaving gold funds run on a little longer. I am not suggesting that the time till then won't hold any challenges. But it is likely to be the most timely exit. Just to annoy you, you may find that, by hook or by crook, markets struggle forward a while longer. Harvesting worthwhile returns from the second week of November, however, will be tougher and vary substantially from region to region.

That first November week will probably mark the end of any positive direction in equity markets this year. May be you should start looking at which bond fund and which currency you want to hold thereafter. And don't hope for the FED to help you with your decision.

Comments