Turnaround in the USD!

When most people bet on one outcome only, it is often the wrong one! Currency traders, carry traders, bond fund managers and commodity traders were all banking on a forever weakening USD. Indeed, they sought to reassure and reaffirm through daily doses of media stories and selective analysis. Such high levels of consensus develop when too many focus on too few factors, like problems with government budgets and deficits, an apparent slow-down in the economy, political storms in the US congress, more trouble in Europe. None of those hit the mark (i.e. really dictate current market behaviour), but hotly discussed in the media and elsewhere. So it must be important? Relevant?

Sure, many trading decisions might be based on such notions, - mainly the short term, ill tempered and ill timed decision by rookies and those who lack the ability, discipline, vision, understanding required. That is OK, too: There are a few good traders, and - many new traders. The latter will have to learn and pay their tuition fees along the way.

But none of the headline stories really explain the recent turnaround in the USD. If you care, you may scan this blog for my earlier comments when I pointed to this mostly unexpected scenario, in several updates since April 2011. (Click here to read the blog from early May!). Currencies play a major role for SGD investors, especially with respect to the direction of the USD. One thing is for sure: every time a foreign market sells off, I find evidence that it was foreign investors selling out, typically from the US or predominantly dealing in USD. How do I know? As soon as there is a major sell off, the USD strengthens, commonly referred to as a flight to safety or quality,though this is not the motivation behind it really.

Finally, if it was really a FLIGHT TO QUALITY, how come Asian sovereign bonds sold off, including Singapore's own, - and Asian currencies are down, including the SGD (-5% against the USD)? The last time this happend was September-October 2008! Until a few days ok, the SGD was considered the hottest currency in Asia and economists were worried about it getting too high for our export industry.

What causes short term USD strength?

Only when the proceeds are repatriated to the US, and converted back to USD, will the currency rise. Hence, signs of a strengthening USD is not a flight of any kind, it is the normal consequence when you sell one thing (demand falls, price goes down) and buy another (=USD, demand soars, prices go up).

Carry Traders

Of course in recent months, the USD has also become favourites with carry traders, i.e. those who borrow USD to invest in other currencies offering higher interest rates for instance. All goes well as long as the USD stays low! But presently, the currency has been rising vis-a-vis most currencies, except the YEN. Hence, carry traders are left with the only sensible thing, which is to return their borrowings and wait for better times to trade. Returning the funds = paying back the borrowed dollars also means less dollars in circulation, which reinforces the bullish trend.

Indecision

As you can see on the chart, after a recent breakout, the USD is now trading just above its half-year trading range. The immediate reaction after a boisterous trading peak last week was to drop back down into the range (just), but Monday (19th in the US) night's pricing pattern forms a 'hammer' candle, indicating some indecision as to the next steps. My own medium term view remains the same: the USD should remain surprisingly stable, and - it will probably not strengthen much further, UNLESS the European politicians mess up big time.

Having said that, there are some who now predict for the Euro to fall to 1.28 to the USD. Not a disaster for the Euro, would it not allow for the debt problems to be tackled at sensible levels, while creating good risk - reward ratios for potential investors like the Chinese Government.

But what will happen when the next round of QE - or whatever new convincing description they may come up with - hits markets? More volatility? Or more pressure on asset prices and inflation? Sounds like a story with more drama and much more excitement to come!

Trading Recommendation

Making investment decision in this market requires 'Rothchildian' vision and grit. Few have it, some dream of it, but most can't even imagine it (and that can be a problem, if the advisor, like me, suggests a good idea to an investor whose head's stuck in the sand. SMILE, I couldn't possibly refer to you, - you are at least reading the blog). if you wanted to know our present strategy, why not drop me a line? Leave a comment?

At this point, swiftness counts coupled with a proverbial Plan B when markets go against your strategy. Betting for the long haul right now looks like playing with fire.

Sure, many trading decisions might be based on such notions, - mainly the short term, ill tempered and ill timed decision by rookies and those who lack the ability, discipline, vision, understanding required. That is OK, too: There are a few good traders, and - many new traders. The latter will have to learn and pay their tuition fees along the way.

|

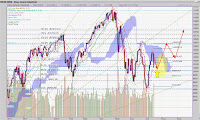

| USD since May till now - range bound |

Finally, if it was really a FLIGHT TO QUALITY, how come Asian sovereign bonds sold off, including Singapore's own, - and Asian currencies are down, including the SGD (-5% against the USD)? The last time this happend was September-October 2008! Until a few days ok, the SGD was considered the hottest currency in Asia and economists were worried about it getting too high for our export industry.

What causes short term USD strength?

Only when the proceeds are repatriated to the US, and converted back to USD, will the currency rise. Hence, signs of a strengthening USD is not a flight of any kind, it is the normal consequence when you sell one thing (demand falls, price goes down) and buy another (=USD, demand soars, prices go up).

Carry Traders

Of course in recent months, the USD has also become favourites with carry traders, i.e. those who borrow USD to invest in other currencies offering higher interest rates for instance. All goes well as long as the USD stays low! But presently, the currency has been rising vis-a-vis most currencies, except the YEN. Hence, carry traders are left with the only sensible thing, which is to return their borrowings and wait for better times to trade. Returning the funds = paying back the borrowed dollars also means less dollars in circulation, which reinforces the bullish trend.

Indecision

As you can see on the chart, after a recent breakout, the USD is now trading just above its half-year trading range. The immediate reaction after a boisterous trading peak last week was to drop back down into the range (just), but Monday (19th in the US) night's pricing pattern forms a 'hammer' candle, indicating some indecision as to the next steps. My own medium term view remains the same: the USD should remain surprisingly stable, and - it will probably not strengthen much further, UNLESS the European politicians mess up big time.

Having said that, there are some who now predict for the Euro to fall to 1.28 to the USD. Not a disaster for the Euro, would it not allow for the debt problems to be tackled at sensible levels, while creating good risk - reward ratios for potential investors like the Chinese Government.

But what will happen when the next round of QE - or whatever new convincing description they may come up with - hits markets? More volatility? Or more pressure on asset prices and inflation? Sounds like a story with more drama and much more excitement to come!

Trading Recommendation

Making investment decision in this market requires 'Rothchildian' vision and grit. Few have it, some dream of it, but most can't even imagine it (and that can be a problem, if the advisor, like me, suggests a good idea to an investor whose head's stuck in the sand. SMILE, I couldn't possibly refer to you, - you are at least reading the blog). if you wanted to know our present strategy, why not drop me a line? Leave a comment?

At this point, swiftness counts coupled with a proverbial Plan B when markets go against your strategy. Betting for the long haul right now looks like playing with fire.

Comments