"Inflection Point" in the stock markets

Overview

Short term review

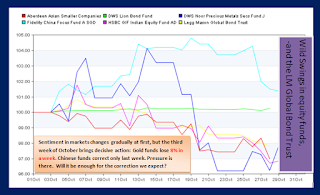

If you thought that funds had had a better week than last, this will disappoint you: more than half of our funds recorded negative performances again, with the worst results in bonds of -0.8% and -2% equity funds. Asia is at the forefront of the losses: India, China and Thailand funds. The best fund return we record for this week is just short of 2% (LionGlobal Taiwan), representing a lagging market.

On a monthly basis, -2.5% shows up as the maximum loss. The best monthly returns (only 5 funds above +6%) have been realised in Asian and Latin American funds, which have one main theme in common: Global Resources. In other words, lowest and highest returns between diversified equity and bond funds are just about 4% apart, much closer together, than the propagated New Bull Market scenario would suggest.

Looking further ahead than just 3-4 weeks, I am not actually envisaging a D-Day scenario for any of the markets. Indeed, we should see more of the Asset Inflation Express of last year again soon. Still, one should consider the implications of what is driving overheating stock markets. Much of the most recent upside is the result of the "wrong liquidity".

In case that sounds too cryptic let me make it clear: Recent fiscal measures by global governments - but mainly in the US -, directed at resolving the shortage of cheaper commercial loans to benefit small and medium size business, quickly found their way into the stock markets instead. It would have been ok still, had it ended up in the stock markets from where the moneys originated, but NO, those same institutions decided to take the bait of the double whammy (Asia) [see blog of last week] driving Asian stock indices to new yearly highs - until October 13th. As it stands, Asian stocks are at the mercy of foreign institutions whose objectives and strategies are NOT in line with economic realities in Asia.

In case that sounds too cryptic let me make it clear: Recent fiscal measures by global governments - but mainly in the US -, directed at resolving the shortage of cheaper commercial loans to benefit small and medium size business, quickly found their way into the stock markets instead. It would have been ok still, had it ended up in the stock markets from where the moneys originated, but NO, those same institutions decided to take the bait of the double whammy (Asia) [see blog of last week] driving Asian stock indices to new yearly highs - until October 13th. As it stands, Asian stocks are at the mercy of foreign institutions whose objectives and strategies are NOT in line with economic realities in Asia.

Market Performances

Since mid October, we see valuations in Asia drift lower, on average about -3% so far, though performances differ greatly from fund to fund, depending on their focus.

Small caps appear to succumb to profit taking as early as September (see first chart), in tandem with Asian tech stocks, while funds carrying stocks in Consumer Goods & Services and Financial sector are still in positive territory. These are the stocks which to American investors traditionally offer the the best risk graded returns.

The fact that the US dollar is strengthening gradually over the last 12 trading days, too, highlights the close (inverse) correlation between these two aspects. By bringing their profits from Asia back to the US, investors create an uplift in the dollar itself. These proceeds though are quickly reinvested in local US stocks, resulting in the apparent "resilience of US capital markets" against the more adverse backdrop of its economies per se. I am probably not far wrong to associate this support with political hopes and dreams for local mid-term elections this week. Should valuations not hold up, or indeed turn into a sharp correction within the next 72 hours, then that would be considered a failure of the FED's strategy and bode unwelcome news for the US current administration.

However, it is the FII flow. still in Asian and Latin American bourses that is causing me much more concern in the short term. in plain English, should FII flows exit these markets in a more decisive effort they are likely to experience considerable turmoil, - not for long - but probably long enough to inflict damage to the unsuspecting investors.

Let me be straight here: As far as our current strategy is concerned, there is little to make me worry. Yes, the continuous - unexpected and unwarranted - run up in US stocks has created a drag on bond prices, being sold off in the hunt for higher returns, after everyone the poor bond holders that equities are that much cheaper, based on P/E ratios! It takes a great marketeer to browbeat the public into accepting -a comparison of apples and oranges, i.e. the two asset classes that are different in more ways than one (P/E ratios)!

Anyway, I never quite understood the argument: if we are buying bonds, we are trying buy safety relative to equities, - even with high yield bonds. Yes, in recent weeks bond funds like the Legg Mason Global Bond and US denominated bonds saw negative performances and that is "ok", as it was the downside risk we took on a month ago. The actual returns are the result of bond valuations going down as well as currency fluctuations against the Singapore Dollar.

Model Portfolios:

The graph above shows model portfolio results since beginning of August, i.e. about 3 months. Switching into bonds in early September, the model portfolios are steadily rising into early October, and only after that do we record a negative momentum, just when we see the unusual upsurge in global indices. Actual volatility in the model portfolios is well within expectations, producing a negative performance of around 1-1.5% since mid October, depending on risk profile and management style.

Against the MSCI World, portfolios may have missed out, but we are in good company: All other managers of our benchmark funds have managed their portfolios in a similar way. The cost-free indices (MSCI) are ahead, - and as I said before: THAT IS OK - we are talking about missing out on a couple percentage points. It is the first time in over 9 months that it happened.

Against the MSCI World, portfolios may have missed out, but we are in good company: All other managers of our benchmark funds have managed their portfolios in a similar way. The cost-free indices (MSCI) are ahead, - and as I said before: THAT IS OK - we are talking about missing out on a couple percentage points. It is the first time in over 9 months that it happened.

Finally, please be assured that we are seeing the tail end of our conservative stance since September. The coming period will soon change things in our favour, again!

By the same token, we should see a near-term turnaround for negatively trending bonds and a strengthening of US $ versus the S$, providing the turnaround for those USD denominated bond funds, too.

The bigger more significant turnaround will come later this month, suddenly and with extraordinary intensity. - I am not disclosing the actual dates for the turning windows here on this blog. But clients and paying subscribers will be kept informed.

Short term review

If you thought that funds had had a better week than last, this will disappoint you: more than half of our funds recorded negative performances again, with the worst results in bonds of -0.8% and -2% equity funds. Asia is at the forefront of the losses: India, China and Thailand funds. The best fund return we record for this week is just short of 2% (LionGlobal Taiwan), representing a lagging market.

On a monthly basis, -2.5% shows up as the maximum loss. The best monthly returns (only 5 funds above +6%) have been realised in Asian and Latin American funds, which have one main theme in common: Global Resources. In other words, lowest and highest returns between diversified equity and bond funds are just about 4% apart, much closer together, than the propagated New Bull Market scenario would suggest.

Looking into this week's real eventsMarc Faber, one of the more reliable and sensible commentators on global stock markets, termed the current phase in his recent interview as "close to an inflection point in the global stock markets". What he did not say quite so explicitly is whether this applies to all markets (total correlation = serious correction) or only the developed world, or else. He also did not put a specific time scale to it either, - but who would in this game between reality and the artificially generated Reflating last year's Reflation Exercise by adding QE2,QE3, 4..?

In case that sounds too cryptic let me make it clear: Recent fiscal measures by global governments - but mainly in the US -, directed at resolving the shortage of cheaper commercial loans to benefit small and medium size business, quickly found their way into the stock markets instead. It would have been ok still, had it ended up in the stock markets from where the moneys originated, but NO, those same institutions decided to take the bait of the double whammy (Asia) [see blog of last week] driving Asian stock indices to new yearly highs - until October 13th. As it stands, Asian stocks are at the mercy of foreign institutions whose objectives and strategies are NOT in line with economic realities in Asia.

In case that sounds too cryptic let me make it clear: Recent fiscal measures by global governments - but mainly in the US -, directed at resolving the shortage of cheaper commercial loans to benefit small and medium size business, quickly found their way into the stock markets instead. It would have been ok still, had it ended up in the stock markets from where the moneys originated, but NO, those same institutions decided to take the bait of the double whammy (Asia) [see blog of last week] driving Asian stock indices to new yearly highs - until October 13th. As it stands, Asian stocks are at the mercy of foreign institutions whose objectives and strategies are NOT in line with economic realities in Asia. Market Performances

Since mid October, we see valuations in Asia drift lower, on average about -3% so far, though performances differ greatly from fund to fund, depending on their focus.

Small caps appear to succumb to profit taking as early as September (see first chart), in tandem with Asian tech stocks, while funds carrying stocks in Consumer Goods & Services and Financial sector are still in positive territory. These are the stocks which to American investors traditionally offer the the best risk graded returns.

The fact that the US dollar is strengthening gradually over the last 12 trading days, too, highlights the close (inverse) correlation between these two aspects. By bringing their profits from Asia back to the US, investors create an uplift in the dollar itself. These proceeds though are quickly reinvested in local US stocks, resulting in the apparent "resilience of US capital markets" against the more adverse backdrop of its economies per se. I am probably not far wrong to associate this support with political hopes and dreams for local mid-term elections this week. Should valuations not hold up, or indeed turn into a sharp correction within the next 72 hours, then that would be considered a failure of the FED's strategy and bode unwelcome news for the US current administration.

However, it is the FII flow. still in Asian and Latin American bourses that is causing me much more concern in the short term. in plain English, should FII flows exit these markets in a more decisive effort they are likely to experience considerable turmoil, - not for long - but probably long enough to inflict damage to the unsuspecting investors.

Our present strategyI had a question over the weekend, which probably quite a few of my investors are mulling over.

Is our current strategy working? Aren't our portfolios losing money right now - for no good reason? With over 80% in bond funds, are we doing the right thing for our portfolios?

Let me be straight here: As far as our current strategy is concerned, there is little to make me worry. Yes, the continuous - unexpected and unwarranted - run up in US stocks has created a drag on bond prices, being sold off in the hunt for higher returns, after everyone the poor bond holders that equities are that much cheaper, based on P/E ratios! It takes a great marketeer to browbeat the public into accepting -a comparison of apples and oranges, i.e. the two asset classes that are different in more ways than one (P/E ratios)!

Bonds are NOMINAL assets, unreal - just like money is, while stocks are REAL, in that their value is a measure of its ability to deliver returns as a result of company earnings that you and I produce. Differences as huge as those have implications on the portfolio strategy, too.

Anyway, I never quite understood the argument: if we are buying bonds, we are trying buy safety relative to equities, - even with high yield bonds. Yes, in recent weeks bond funds like the Legg Mason Global Bond and US denominated bonds saw negative performances and that is "ok", as it was the downside risk we took on a month ago. The actual returns are the result of bond valuations going down as well as currency fluctuations against the Singapore Dollar.

Model Portfolios:

The graph above shows model portfolio results since beginning of August, i.e. about 3 months. Switching into bonds in early September, the model portfolios are steadily rising into early October, and only after that do we record a negative momentum, just when we see the unusual upsurge in global indices. Actual volatility in the model portfolios is well within expectations, producing a negative performance of around 1-1.5% since mid October, depending on risk profile and management style.

Against the MSCI World, portfolios may have missed out, but we are in good company: All other managers of our benchmark funds have managed their portfolios in a similar way. The cost-free indices (MSCI) are ahead, - and as I said before: THAT IS OK - we are talking about missing out on a couple percentage points. It is the first time in over 9 months that it happened.

Against the MSCI World, portfolios may have missed out, but we are in good company: All other managers of our benchmark funds have managed their portfolios in a similar way. The cost-free indices (MSCI) are ahead, - and as I said before: THAT IS OK - we are talking about missing out on a couple percentage points. It is the first time in over 9 months that it happened. Finally, please be assured that we are seeing the tail end of our conservative stance since September. The coming period will soon change things in our favour, again!

VERY SHORT-TERM CONSIDERATIONSIn the short term I remain conservative in my recommendations. The next two weeks my cyclical indicators as well as many technical indicators for the Asian region, Australia and Latin America remain bearish. I am in no doubt that capital markets will be subjected to more interventions from many central banks, which in turn will distort perceptions and realities. But I am pretty sure that Asian stocks are more likely to continue trending SOUTH.

By the same token, we should see a near-term turnaround for negatively trending bonds and a strengthening of US $ versus the S$, providing the turnaround for those USD denominated bond funds, too.

The bigger more significant turnaround will come later this month, suddenly and with extraordinary intensity. - I am not disclosing the actual dates for the turning windows here on this blog. But clients and paying subscribers will be kept informed.

2-Week Outlook - for a few stock markets at risk

India: having seen a parabolic rise, this market is primed for a correction of some magnitude for the coming weeks.

The Bovespa of Brazil also shows signs that should lead to a sizeable correction.

Hong Kong's Hang Seng went up sharply on the back of the Mainland China stock rally, but now suffers the first of foreign investors taking profit and taking the proceeds elsewhere.

But the picture is not as clear for the Australian markets, Singapore's STI and a few others. Somehow I think the picture will become clearer over the next two weeks.

Happy Investing.

The Bovespa of Brazil also shows signs that should lead to a sizeable correction.

Hong Kong's Hang Seng went up sharply on the back of the Mainland China stock rally, but now suffers the first of foreign investors taking profit and taking the proceeds elsewhere.

But the picture is not as clear for the Australian markets, Singapore's STI and a few others. Somehow I think the picture will become clearer over the next two weeks.

Happy Investing.

Comments