The FED speaks - and Investor Hearts Miss a Beat!?

Just a brief interlude for your enjoyment!

The rude awakening may come later...

Yesterday, the FED managed to move (index-) mountains,short term:

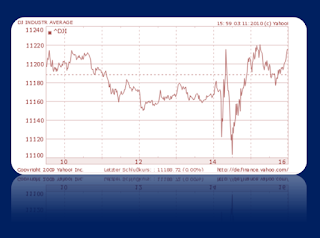

In the run up to the announcement on the latest QE, a lull was in the market (DJIA 1-day Chart, on the right). Then we see a sudden exhilarating, erratic move, much like on an ECG. Jolted into action, prices first moved down, then up, down further and finally up, with more emphasis.

Sounds great until we note that actual volatility is less than 1%. It suggests that rather than missing a beat, investor reaction was that of geriatric fingering on the keyboard...

I am not good at dissecting FED messages in search of mystical clues and hidden meanings, so I will refrain to comment on the actual QE proposal. Most of my readers know by now that I am with the hawks on this. I am not convinced America can spend itself out of the mess they created, especially when America's investors don't invest in the US or the USD anymore!

Just to re-emphasise my recent argument of viewing performance in indices through the eyes of SGD investors: US stocks may have advanced by some 0.3% (in USD), yet its currency moved down from 1.289 to 1.285 against the SGD, the same 0.3% the indices seemingly advanced.

I did not expect for the earth to move with the release of the new QE proposal but the actual reaction by market participants is likely going to disappoint even FED officials. - Or may be it will take some time for the penny to drop? In that case, I sense that disappointment will outweigh optimism having expected as much as $2 Trillion in monetary easing (earlier Goldman Sachs statement).

We shall see, soon probably! Anyway, mid-term elections have shifted mind and messages to more accountable, responsible money management. This would conform with the European views, - and therefore stand a better chance of succeeding, in the medium term.

The rude awakening may come later...

Yesterday, the FED managed to move (index-) mountains,short term:

In the run up to the announcement on the latest QE, a lull was in the market (DJIA 1-day Chart, on the right). Then we see a sudden exhilarating, erratic move, much like on an ECG. Jolted into action, prices first moved down, then up, down further and finally up, with more emphasis.

Sounds great until we note that actual volatility is less than 1%. It suggests that rather than missing a beat, investor reaction was that of geriatric fingering on the keyboard...

I am not good at dissecting FED messages in search of mystical clues and hidden meanings, so I will refrain to comment on the actual QE proposal. Most of my readers know by now that I am with the hawks on this. I am not convinced America can spend itself out of the mess they created, especially when America's investors don't invest in the US or the USD anymore!

Just to re-emphasise my recent argument of viewing performance in indices through the eyes of SGD investors: US stocks may have advanced by some 0.3% (in USD), yet its currency moved down from 1.289 to 1.285 against the SGD, the same 0.3% the indices seemingly advanced.

I did not expect for the earth to move with the release of the new QE proposal but the actual reaction by market participants is likely going to disappoint even FED officials. - Or may be it will take some time for the penny to drop? In that case, I sense that disappointment will outweigh optimism having expected as much as $2 Trillion in monetary easing (earlier Goldman Sachs statement).

Are hints at future action a viable solution?

People Don't Like To Be Kept In Suspense For Long!

We shall see, soon probably! Anyway, mid-term elections have shifted mind and messages to more accountable, responsible money management. This would conform with the European views, - and therefore stand a better chance of succeeding, in the medium term.

Tomorrow my family and community are celebrating

the Indian Festival of Lights, denoting success in the fight of Good over Evil, and ideal starting point for new ventures.

Wishing our investors, ALL investors, enlightened trades - for the right reasons and a successful outcome now and in the future!

Comments